The Ultimate Guide to Creditor Negotiation for Business Owners

The Ultimate Guide to Creditor Negotiation for Business Owners Introduction: Why Creditor Negotiation Matters in 2026 In 2026, many business owners face financial pressure not because their companies are failing, but because debt terms no longer match cash flow reality. Aggressive repayment schedules, short-term financing, and economic uncertainty have made creditor negotiation a critical skill. […]

How Business Debt Relief Services Can Boost Your Company’s Creditworthiness

How Business Debt Relief Services Can Boost Your Company’s Creditworthiness Introduction: Why Creditworthiness Matters More Than Ever in 2026 Strong business credit is essential for securing future financing, favorable loan terms, and growth opportunities. Many companies struggle with high-interest debt, merchant cash advances, or defaulted loans, which can damage credit scores and limit funding options. […]

Top 5 Mistakes Businesses Make WhenManaging High-Interest Loans

Top 5 Mistakes Businesses Make When Managing High-Interest Loans Introduction: High-Interest Loans Become a Silent Risk in 2026 High-interest business loans are often taken with the intention of solving short-term problems, but without proper management, they quickly become long-term liabilities. In 2026, many businesses fall into financial distress not because of poor performance, but because […]

Alternative Small Business Cash Advance Options That Won’tSink Your Cash Flow

Alternative Small Business Cash Advance Options That Won’t Sink Your Cash Flow When small business owners face unexpected expenses or seasonal revenue dips, they often turn to quick financing solutions. While traditional small business cash advances can provide immediate funds, the high fees and aggressive repayment terms can strain your cash flow. The good news […]

The Pros and Cons of Merchant Cash Advances for Small Businesses

The Pros and Cons of Merchant Cash Advances for Small Businesses When small businesses face sudden expenses or cash flow gaps, a Merchant Cash Advance (MCA) can seem like a quick and flexible solution. However, before making a decision, it’s important to understand the real advantages and disadvantages, especially since MCAs work very differently from […]

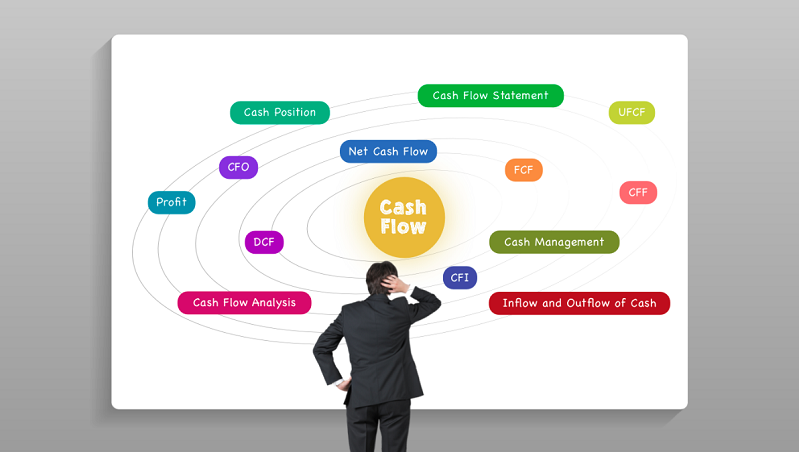

5 Signs Your Business Needs a Cash FlowBoost, and How to Get It Fast

5 Signs Your Business Needs a Cash FlowBoost, and How to Get It Fast 5 Signs Your Business Needs a Cash Flow Boost, and How to Get It Fast Cash flow is the lifeline of every business. When it slows down, even profitable companies canface unexpected challenges. Knowing the early warning signs can help you […]

Small Business Cash Advance Near Me:Finding the Smartest Funding Partner forYour Business

Small Business Cash Advance Near Me: Finding the Smartest Funding Partner for Your Business When your business needs quick capital, it’s tempting to pull out your phone and type “small business cash advance near me” into Google. The search results will flood you with offers, some promising same-day funding, others claiming “zero risk” or “no […]

Merchant Cash Advance vs. BusinessLoan: Which Is Better for Your Business?

Merchant Cash Advance vs. Business Loan: Which Is Better for Your Business? Running a business often means facing situations where your cash flow gets tight,whether due to seasonal dips, delayed invoices, or sudden opportunities that require quick capital. In these moments, two common financing options often come up: Merchant Cash Advances (MCAs) and Business Loans. […]

When Is the Right Time to Start a Business Debt Mediation Process?

When Is the Right Time to Start a Business Debt Mediation Process? If you’re waiting for a loan default, frozen bank accounts, or court notices before addressing your debt , you’ve already waited too long. In 2025’s high-interest environment, proactive financial intervention is your biggest advantage.At National Credit Partners, we’ve guided hundreds of U.S. businesses […]

How to Protect Your Business Credit Score While Restructuring Debt

How to Protect Your Business Credit Score While Restructuring Debt Restructuring debt can be a lifeline for struggling businesses, but if not done strategically, it can damage your business credit score , one of the most critical assets for long-term financial health. Many business owners fear that entering debt relief or mediation will automatically hurt […]