How the 2025 Economy Affects Small Business Debt Across the US

Holiday Hiring & High Expenses: How to Keep Debt From Derailing Your Business in Q4 The fourth quarter is both the most exciting and the most stressful time of the year for U.S. business owners. Between holiday hiring, seasonal marketing campaigns, increased inventory orders, and higher operating costs, expenses can skyrocket right when cash flowis […]

Bankruptcy vs. Debt Restructuring: Protect Your Business Future

Bankruptcy vs. Business Debt Restructuring: Which Path Protects Your Future? Running a business in the U.S. is challenging, even more so when debt piles up. Whether it’s merchant cash advances, high-interest loans, unpaid vendors, or tax obligations, many business owners eventually reach a breaking point. At that stage, two options often dominatethe conversation: ● File […]

The Pros and Cons of Merchant Cash Advances for Small Businesses

The Pros and Cons of Merchant Cash Advances for Small Businesses When small businesses face sudden expenses or cash flow gaps, a Merchant Cash Advance (MCA) can seem like a quick and flexible solution. However, before making a decision, it’s important to understand the real advantages and disadvantages, especially since MCAs work very differently from […]

Small Business Cash Advance: What It Is,How It Works, and Who Should Use It

Small Business Cash Advance: What It Is, How It Works, and Who Should Use It For many small business owners, cash flow can be unpredictable. Unexpected expenses,seasonal slowdowns, or urgent growth opportunities can all create a sudden need for quickfunding. One financing option that has gained popularity in recent years is the small businesscash advance. […]

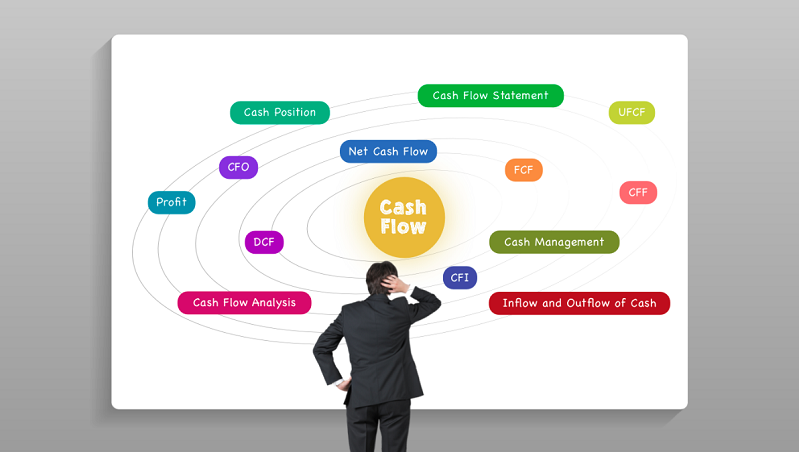

5 Signs Your Business Needs a Cash FlowBoost, and How to Get It Fast

5 Signs Your Business Needs a Cash FlowBoost, and How to Get It Fast 5 Signs Your Business Needs a Cash Flow Boost, and How to Get It Fast Cash flow is the lifeline of every business. When it slows down, even profitable companies canface unexpected challenges. Knowing the early warning signs can help you […]

When Is the Right Time to Start a Business Debt Mediation Process?

When Is the Right Time to Start a Business Debt Mediation Process? If you’re waiting for a loan default, frozen bank accounts, or court notices before addressing your debt , you’ve already waited too long. In 2025’s high-interest environment, proactive financial intervention is your biggest advantage.At National Credit Partners, we’ve guided hundreds of U.S. businesses […]

How to Protect Your Business Credit Score While Restructuring Debt

How to Protect Your Business Credit Score While Restructuring Debt Restructuring debt can be a lifeline for struggling businesses, but if not done strategically, it can damage your business credit score , one of the most critical assets for long-term financial health. Many business owners fear that entering debt relief or mediation will automatically hurt […]

How the 2025 Economy Affects Small Business Debt Across the US

How the 2025 Economy Affects Small Business Debt Across the US As the U.S. economy moves through 2025, small businesses across the country are feeling the pressure , from rising inflation to tighter lending, and a wave of loan defaults threatening both operations and credit health. If you’re carrying commercial debt, understanding how the current […]

The Future of Business Debt Mediation: Expert Predictions for 2025

The Future of Business Debt Mediation: Expert Predictions for 2025 In recent years, thousands of U.S. businesses , from startups to mid-sized firms , have turnedto business debt mediation as an alternative to collections, legal action, or financial collapse.As we enter 2025, this method of resolving commercial debt continues to evolve, influenced byshifting lending regulations, […]

Bankruptcy vs Business Debt Restructuring: What’s Better in 2025?

Bankruptcy vs Business Debt Restructuring: What’s Better in 2025? In today’s challenging economic landscape, small business owners struggling with mounting debt often face a crucial decision: declaring bankruptcy or pursuing business debt restructuring. Each option offers a path to financial recovery, but the consequences, advantages, and long-term impacts vary widely. In this guide, we’ll break […]